Opening a demat account is crucial for anyone looking to begin investing in the Indian stock market. Your demat account, which is held in an electronic format and makes buying and selling simple, is where your bond, mutual fund, and share investments are housed. However, before you begin investing, you should know what documentation is needed to open a demat account. Everything you need to know is presented here in an easy-to-read format so you can open your demat account with ease.

Why Is a Demat Account Important and What Is It?

The monetary holdings of an account are kept in a digital box known as a demat account, or dematerialized account. Instead of being stored on paper share certificates, all of your assets are kept online, saving you time and reducing the risk of loss or damage. To sell on the Indian stock exchange, one must have a demat account. Whether a person is upgrading to a higher platform or purchasing them for the first time, knowing the proper paperwork will provide a free and simple setup.

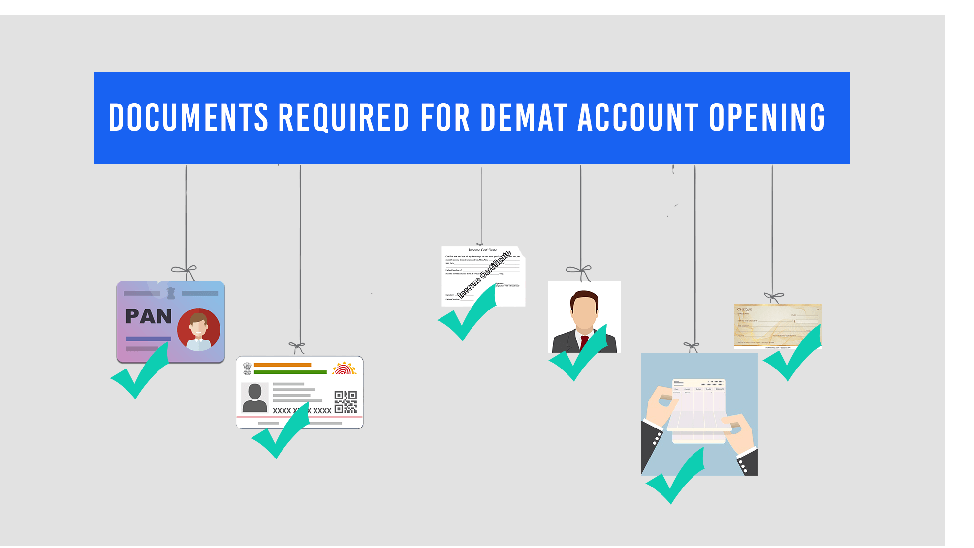

Important Records Required to Open a Demat Account

You must provide basic identification, proof of address, and, in rare cases, proof of income in order to open a demat account. These documents are important for protecting your interests and adhering to SEBI’s (Securities and Exchange Board of India) regulatory requirements.

Identity Verification (POI)

A government photo ID is typically required for this identity document, which displays your identify.

POI papers that are frequently accepted include: ● Aadhaar card ● Passport ● Driver’s license ●

Voter ID card ● PAN card (required for demat accounts)

The PAN card is a crucial document that guarantees financial transactions are open since it relates to your tax records.

Proof of Address (POA)

Your proof of address helps fight fraud by showing where you live.

● Aadhaar card

● Passport

● Voter ID card

● Driving license

POA paperwork is commonly accepted for recent utility bills, such as those for water, gas, or electricity, which are usually no older than three months.

Passbooks or bank statements with your address on them

Proof of Income (Optional, but Required for Certain Trading Types)

If you want to trade in derivatives like futures and options or invest in commodities, brokers may ask for proof of income to assess your financial stability. Documents for income proof might be:

● Latest salary slips

● Form 16

● Bank statements from the last 6 months

● Income Tax Returns

Photograph and Digital Signature

Most brokers will also require a digital signature and a recent passport-size photo during the

online application process. These aid in e-KYC (electronic Know Your Customer) identification and completely eliminate paper from the account opening procedure.

Details of the Bank Account

Joining your current bank account is required since it permits activities such as financial transfers and transactions related to your share market purchases. The following must be provided: ● Cancelled check leaf

- Bank statement or passbook including account number, IFSC code, and office details

Demat Accounts for Special Situations and Minors

A parent or legal guardian must oversee a demat account, even though a minor may open one. The guardian must present their PAN card and proof of identity in addition to the minor’s birth certificate. For non-residents, additional documents may be required, including a current visa, proof of living abroad, and a general power of attorney.

How Do Stock Market Apps Make Submitting Documents Easier?

Setting up a demat account with stock market software is easy and cost-free with today’s technology. Applications that guide you through the entire process allow you to submit scanned copies or images of your documents online. Because Aadhaar-based e-KYC completes verification rapidly, it lessens the need for in-person branch visits. This tech-savvy approach saves time and makes investing possible anywhere, at any time.

In conclusion

Opening a demat account is the first step to learning about the fascinating world of share market

trading. You may prepare ahead and cut down on delays by being aware of the crucial documents, such as identity, proof of address, proof of income, and bank account details. Thanks to digital platforms and easy-to-use technologies, starting a demat account is now free and straightforward for investors of all experience levels. With just a few clicks, you may start your purchasing process once you have your documents.